The Shift in Private Capital Sources: Europe Edition.

“As regulation tightens and investors diversify, fund managers must evolve from manual oversight to intelligent operations.”

Europe’s private capital ecosystem is undergoing a structural transformation.

Traditional institutional LP dominance is giving way to a more diversified, tech-enabled investor base, spanning family offices, private wealth platforms, and evergreen capital structures. This evolution is being accelerated by regulatory convergence across the UK and EU, heightened ESG scrutiny, and the digital overhaul of fund operations.

Using insights derived from Finela’s AI intelligence framework, this report explores how managers across Luxembourg, the Channel Islands, Switzerland, and the UK are re-architecting their operating models to stay competitive.

The findings point to one defining truth: in the next chapter of private capital, operational intelligence, not just capital, will determine performance.

Capital Shift: From Institutional Dominance to Diversified Flows.

Key Trends:

The European private capital market is expanding beyond traditional institutional capital sources.

Family offices and high-net-worth investors now account for nearly 30% of new fund inflows, driven by a preference for direct access, longer-term strategies, and thematic investments such as climate, digital infrastructure, and sustainability.

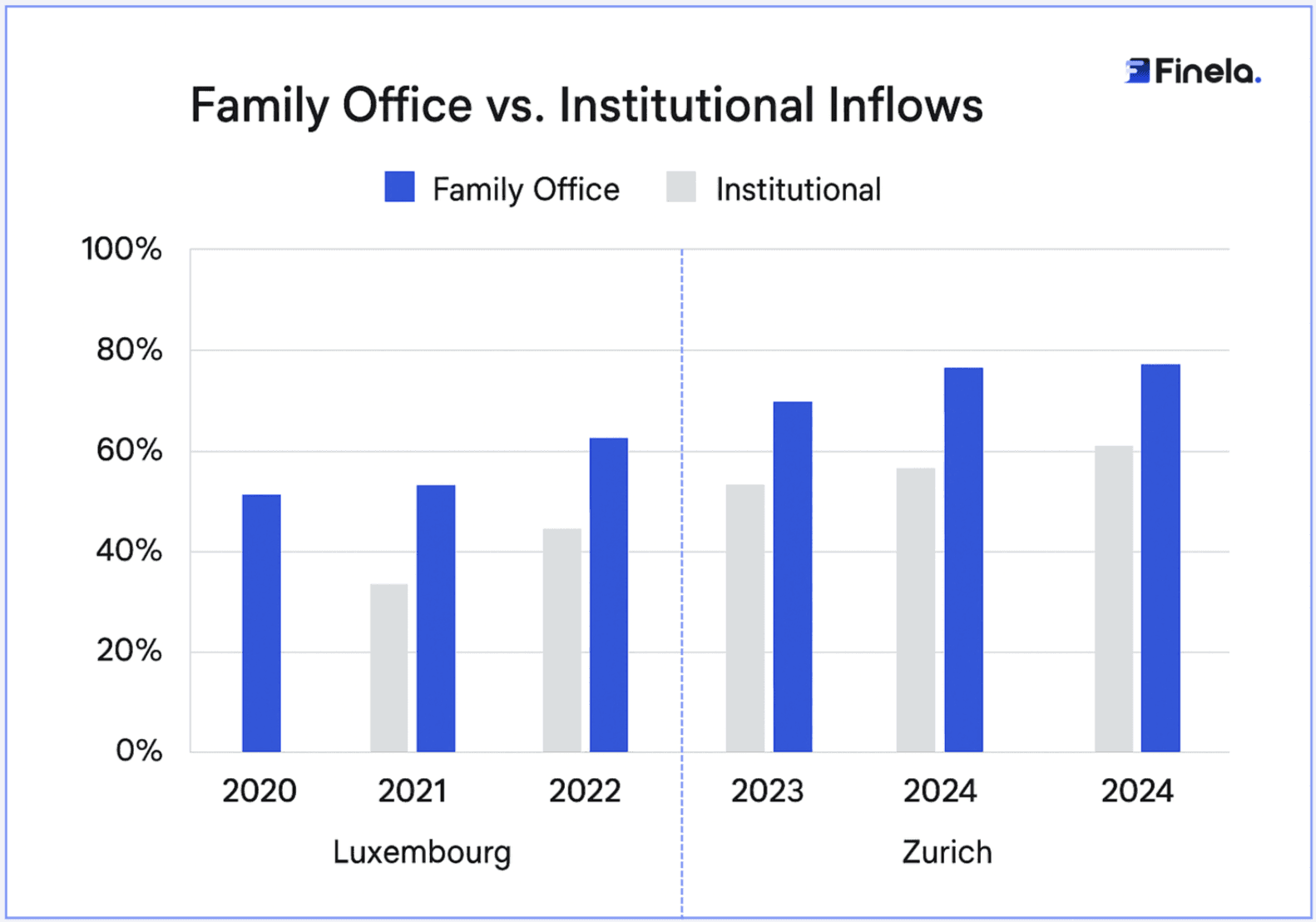

Data Insight:

Finela’s intelligence layer reveals a 28% growth in family office allocations to mid-market private equity funds between 2021 and 2024, concentrated in Luxembourg and Zurich. These hubs are now magnets for global private wealth seeking regulatory credibility and data transparency.

Operational Implications:

Fund managers must adopt multi-channel sourcing strategies that integrate institutional, private, and retail pathways.

Platforms like Finela’s portfolio intelligence module, enable predictive analytics to identify emerging LP interest zones, optimizing outreach and improving fundraising efficiency.

Regulatory Dynamics: Navigating a Fragmented Landscape.

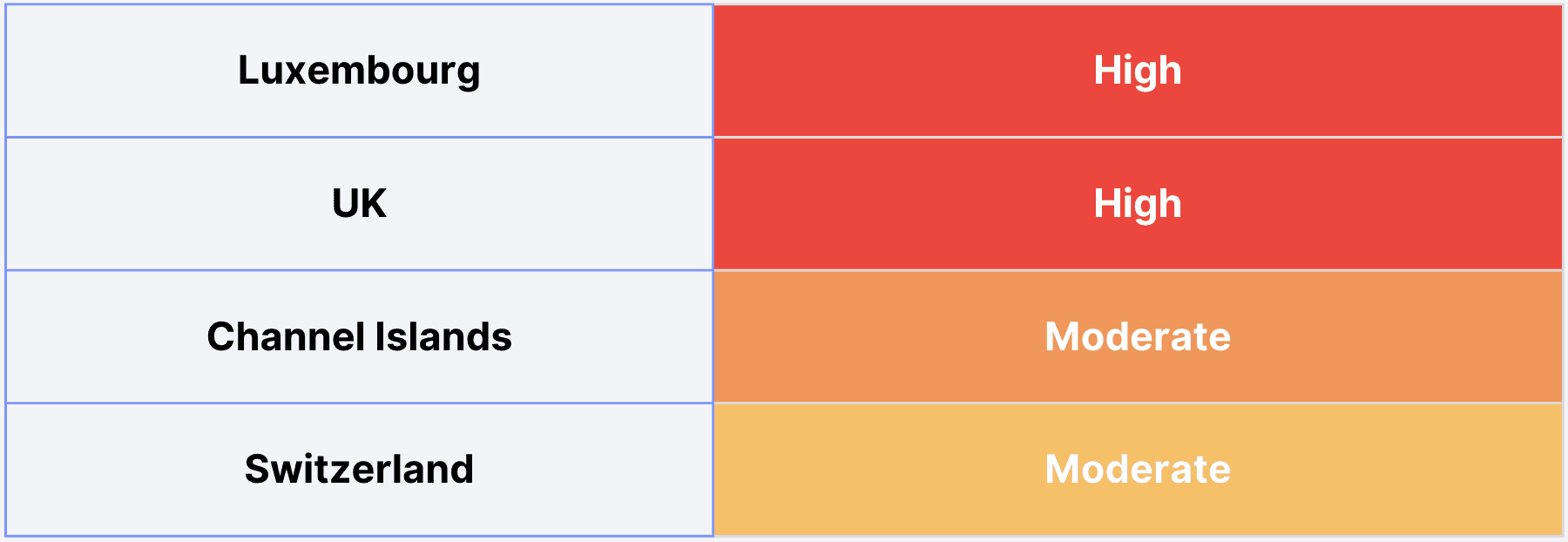

Europe’s regulatory framework is evolving unevenly, harmonised by EU directives yet fragmented by local enforcement. Each jurisdiction presents distinct operational challenges that require precision, automation, and localised intelligence.

Jurisdiction | Regulatory Theme | Operational Implication |

Luxembourg | AIFMD II, SFDR, ESG data mandates | Adoption of digital compliance platforms (e.g., Kycera) for real-time reporting. |

Channel Islands | Substance and transparency obligations | Governance redesign and local board independence are critical for continued compliance. |

Switzerland | LSFin and FinIA licensing | Stricter investor protection extends fund setup timelines through additional due diligence. |

UK | Divergent FCA frameworks | Dual compliance structures are now essential for cross-border capital raising. |

COO Insight:

Compliance has evolved from an administrative cost to a strategic asset.

AI and RegTech solutions automate filings and KYC workflows, reducing manual errors and compliance costs by up to 50% while increasing audit readiness.

Regulatory Complexity Index:

Technology as the New Capital Enabler.

Technology is reshaping every dimension of fund operations from sourcing capital to managing compliance and investor relations. European fund managers are increasingly leveraging AI, RegTech, and RPA to enhance speed, precision, and trust.

Technology Layer | Operational Benefit | Strategic Outcome |

AI & Advanced Analytics | Predict investor behavior and optimize fundraising pipelines. | Improved allocation accuracy and faster access to capital. |

RegTech Platforms | Automate compliance filings and tax submissions (e.g., Lusitax). | Real-time regulatory alignment and risk reduction. |

RPA (Robotic Process Automation) | Streamline onboarding, reporting, and reconciliations. | 40% reduction in manual errors and faster closing cycles. |

Blockchain Infrastructure | Enable secure, transparent settlements. | Elevated LP confidence through immutable data integrity. |

Case Insight:

According to Decile Group data, fund managers who embedded AI-driven investor-matching tools raised ~1.4× more initial commitments than peers, demonstrating the fundraising upside of technology-enabled workflows.

Finela Insight:

Technology has become the new capital distribution edge, turning data into foresight and compliance into confidence.

ESG and Stakeholder Governance: From Reporting to Reputation.

ESG integration is no longer optional, it’s the new performance benchmark.

Investors and regulators expect auditable, outcome-based ESG reporting, while boards face pressure to institutionalise sustainability oversight.

Key Shifts:

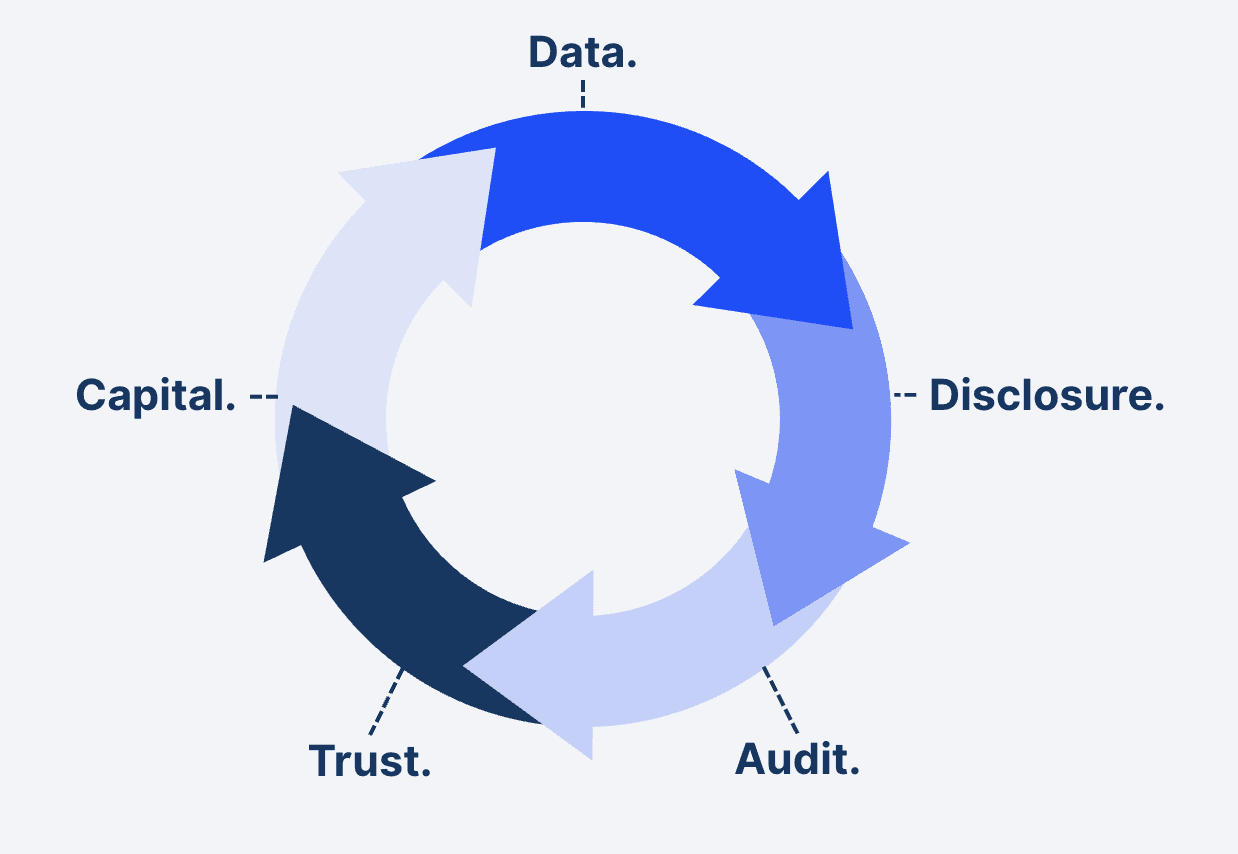

Auditable ESG Data: Disclosure frameworks now require verifiable outcomes, not policy statements.

LP Integration: Performance fees increasingly link to sustainable returns.

Board Oversight: Sustainability committees and third-party audits are expanding across European funds.

AI-Driven Assurance:

Finela’s NLP-driven ESG module detected data inconsistencies within one fund’s sustainability disclosures, helping correct potential inaccuracies that could have resulted in $5M in penalties.

COO Takeaway:

Automate ESG compliance with AI/NLP to reduce audit risk, enhance credibility, and streamline sustainability assurance.

COO/CFO Action Framework: Building the Intelligent Fund.

Operational Challenge | Strategic Pivot | Intelligent Outcome (via Finela) |

Capital Fragmentation | Multi-channel sourcing through AI-led LP targeting. | 25% higher close rate from optimized outreach. |

Compliance Overload | Implement RegTech (e.g., Lusitax, Kycera) and RPA automation. | 50% reduction in administrative costs. |

ESG Reporting Pressure | Deploy NLP-powered ESG monitoring tools. | 30% reduction in audit risk exposure. |

Investor Transparency | Unified governance dashboards for LP reporting. | Real-time engagement and stronger investor alignment. |

Action Imperative:

Firms integrating AI-driven operational intelligence achieve:

25–30% lower compliance costs

40% faster onboarding cycles

Enhanced ESG accuracy and investor satisfaction

Europe’s Inflection Point: A Strategic Outlook.

Europe’s private capital market stands at a crossroads of regulation, innovation, and investor sophistication. Fund managers who synchronise capital flows, regulatory obligations, and stakeholder sentiment will lead this transformation.

Real-World Scenario:

A mid-sized European private equity firm integrated Finela’s operating layer across its Luxembourg, UK, and Channel Islands entities to unify compliance, investor relations, and ESG reporting. Within 12 months, the firm achieved:

35% reduction in compliance costs via automated filings and RegTech workflows.

15% increase in new fund commitments through AI-driven LP targeting.

25% improvement in ESG data accuracy using Finela’s NLP-powered verification tools.

This transition demonstrates how operational intelligence can elevate both performance and credibility turning fragmented workflows into a single, data-driven system of growth.

Strategic Outlook:

The most successful fund managers of the next decade will not just manage assets, they will orchestrate intelligence.

Conclusion: From Operational Agility to Intelligent Advantage.

The shift in private capital sources marks a defining moment for European fund management. As private wealth, regulatory oversight, and technological capability converge, competitive advantage will hinge not on scale, but on how intelligently firms operate.

Fund managers who embed AI-driven workflows, data-led compliance, and transparent governance systems are redefining what best practice looks like. The next generation of leaders will outperform peers not by moving faster, but by thinking smarter, acting earlier, and operating intelligently.

Key Takeaways for Fund Leaders.

Build Intelligence into Every Layer of Operations:

Integrate AI into due diligence, investor engagement, and compliance monitoring to turn data into foresight.

Outcome: Predictive fund operations and accelerated decision cycles.

Treat Compliance as a Strategic Enabler:

Adopt RegTech and RPA tools to automate filings, KYC, and ESG data collection.

Outcome: 25–50% cost reduction and improved regulatory resilience.

Redefine Investor Relationships:

Use real-time dashboards and AI insights to deepen transparency and strengthen LP trust.

Outcome: Increased LP retention and higher close rates on new commitments.

Operationalise ESG with Measurable Impact:

Leverage AI/NLP to monitor ESG performance continuously, not just at audit time.

Outcome: Verified sustainability outcomes and risk reduction.

Build for Continuity, Not Complexity:

Simplify workflows across jurisdictions using integrated digital infrastructure.

Outcome: Unified operations and scalable growth across fund structures.

Finela Insight:

Finela stands at the center of this evolution, the AI operating layer for private capital.

By transforming operational workflows into intelligent growth systems, Finela enables fund leaders to move from reactive management to predictive intelligence, setting a new benchmark for performance and trust in the private markets.

“The next era of private capital won’t be defined by where capital comes from, but by how intelligently it’s managed.”

Finela empowers fund managers to transform data, regulation, and insight into a unified, intelligent advantage.