The Intelligent Fund: Redefining Private Capital Operations.

Technology. Investors. Regulation. Converging to Create a New Era of Operational Advantage.

Private capital operations are no longer back-office support, they are the engine of competitive differentiation. Today, technological disruption, evolving investor demands, and tightening regulatory expectations are colliding with a fast-moving market. Firms that convert these pressures into operational intelligence will outperform peers, restore broken returns, and build lasting investor confidence.

Why This Matters:

Speed and Insight: Market volatility and deal complexity are accelerating. AI and automation turn fragmented data into predictive intelligence, enabling faster decisions, smarter capital allocation, and more consistent returns.

Investor and LP Confidence: Limited partners demand transparency, ESG integration, and co-created growth strategies. Funds that deliver measurable impact and clear reporting strengthen relationships, increase capital inflows, and protect reputation.

Regulatory Credibility: Compliance is no longer a checkbox, it is a source of trust. RegTech, automated monitoring, and real-time oversight ensure funds operate within evolving global standards while minimizing risk exposure.

The Bottom Line:

Firms that master these forces don’t just survive, they unlock operational alpha, restore underperforming portfolios, and set the pace for the next generation of private capital.

Forces Reshaping Private Capital Operations.

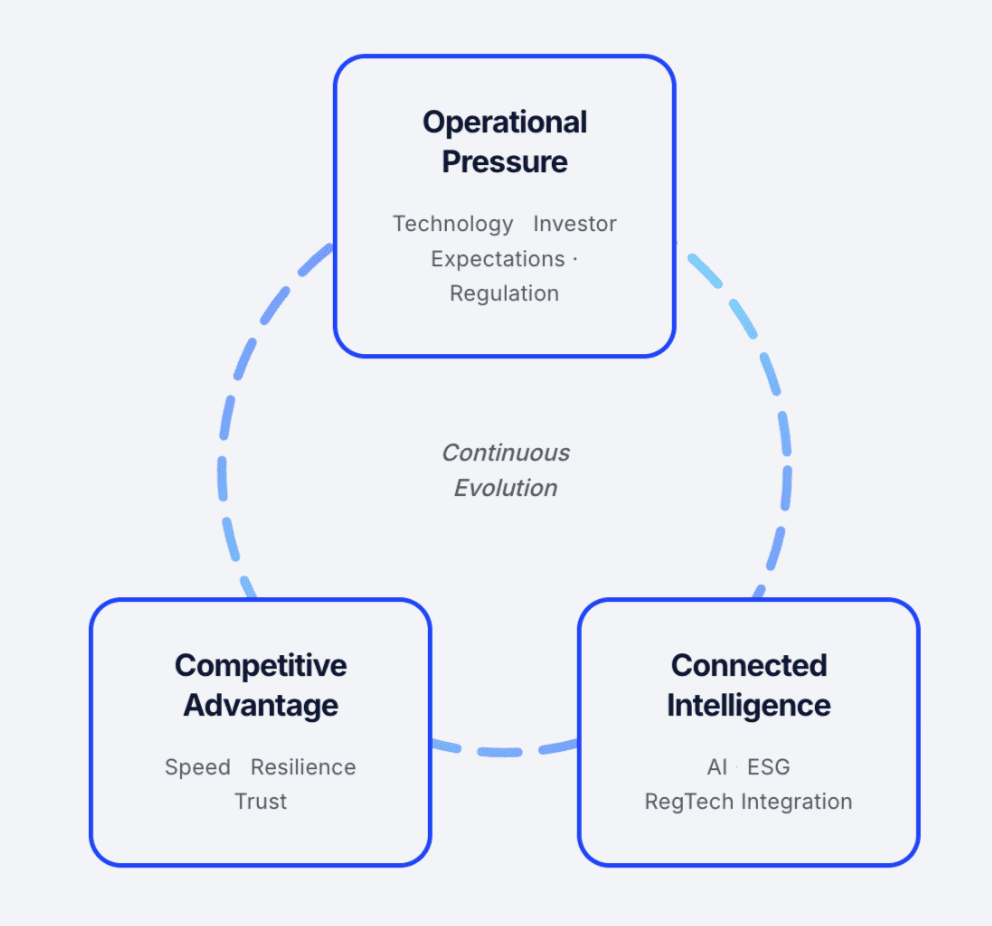

The private capital landscape is undergoing a fundamental shift. What were once isolated pressures (technological innovation, investor scrutiny, and regulatory oversight), have now converged into a single operating reality. Firms are being redefined not by the assets they manage, but by the intelligence of their operations.

The following analysis highlights the three dominant forces reshaping how fund managers execute, report, and create value, and maps where transformation pressure is highest and capability maturity is emerging. This dual lens reveals both the urgency and the opportunity behind operational reinvention in private capital.

Force | Operational Pressure | Action Signal |

Technology Adoption | Data fragmentation, manual workflows, and speed of insight. | Deploy AI portfolio intelligence and RPA to automate diligence, monitoring, and reporting. |

Investor Demands | Shift from returns-only to transparency, ESG, and co-creation. | Embed ESG scoring into deal evaluation and collaborate on strategic growth. |

Regulatory Complexity | Real-time oversight, cross-border standards, and audit expectations. | Implement RegTech for automated compliance and structured governance frameworks. |

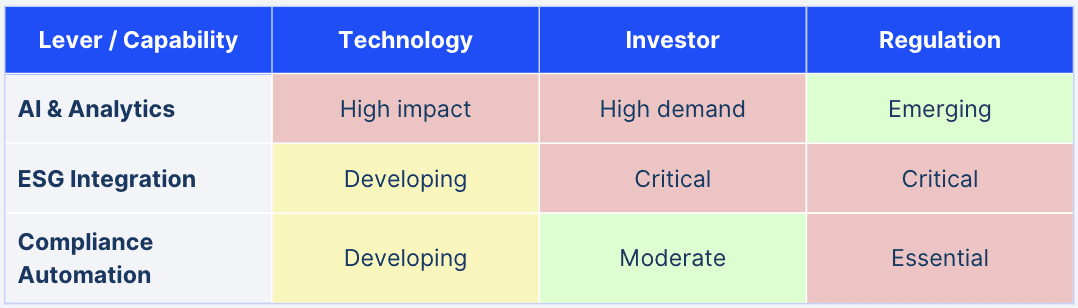

Capability Heatmap.

(Cells are colour-coded to show level of transformation).

Modern fund management is no longer linear. Technology innovation, investor scrutiny, and regulatory oversight now converge at every stage of the investment lifecycle, creating both complexity and competitive advantage.

The table below illustrates where these forces exert the most influence and how leading firms are responding with AI-driven capabilities:

Operational Stage | Technology Adoption | Investor Demands | Regulatory Complexity |

Pre-Investment | Automated due diligence, AI-powered market scanning, and predictive deal scoring improve origination accuracy. | Investors request visibility into ESG impact at sourcing stage; pressure for alignment with sustainability goals. | KYC/AML automation and digital identity verification streamline regulatory onboarding. |

Investment Execution | AI-driven portfolio intelligence forecasts exit timing and value creation levers. | Collaborative governance models with management teams enhance accountability. | RegTech integration automates compliance tracking during transactions. |

Post-Investment | RPA reduces operational errors; blockchain ensures audit-proof transaction transparency. | Investors focus on long-term, compounding value rather than short-term returns. | Real-time data reporting ensures transparent regulator and LP communication. |

Finela Insight:

The intersection of these forces defines a new frontier ‘The Intelligent Fund’ where operational alpha is created not through scale, but through connected intelligence across every function.

The Expanding Role of the C-Suite.

In today’s private capital landscape, the C-suite operates at the intersection of intelligence, governance, and impact. Leadership is no longer about oversight, it’s about orchestrating data, ethics, and regulation into a cohesive operating system. Finela’s analysis identifies three interlocking domains that define the ‘Leadership Equilibrium Framework’, a model for next-generation executive performance in private capital.

Technology Leadership & Data Literacy:

The modern C-suite must act as a technology catalyst, ensuring that data becomes a strategic asset, not a technical afterthought. AI and analytics are reshaping how executives identify value and predict outcomes.

Leadership Actions:

Champion enterprise-wide AI adoption to enable predictive portfolio insights.

Build data literacy across leadership teams through training in visualization and predictive modeling.

Track success via KPIs such as model accuracy, adoption rates, and decision velocity.

Finela Insight:

Firms with strong digital leadership outperform peers by up to 30% in decision speed and deal ROI, proving that tech fluency is now a fiduciary duty.

ESG Leadership:

ESG has evolved from a reporting requirement to a strategic growth driver.

Executives must translate purpose into performance, aligning sustainability with capital creation.

Leadership Actions:

Integrate ESG metrics into due diligence, monitoring, and reporting frameworks.

Quantify impact through standardized scoring models and AI-assisted ESG analytics.

Communicate sustainability results transparently to investors and boards.

Case Insight:

McKinsey’s sustainability playbook in private equity demonstrates how proactive ESG leadership drives both reputational and financial alpha.

Compliance Stewardship:

The compliance function has shifted from reactive governance to predictive risk intelligence. C-suite leaders now oversee digital compliance architectures that evolve as regulations do.

Leadership Actions:

Adopt RegTech solutions for automated monitoring and anomaly detection.

Embed compliance workflows into daily operations rather than periodic audits.

Engage regulators proactively to shape best practices and maintain transparency.

Finela Insight:

Regulatory stewardship is emerging as a mark of credibility, the most trusted funds are those whose compliance is visible, verifiable, and intelligently automated.

AI & Compliance: Balancing Innovation with Oversight.

As AI becomes the backbone of private capital operations, compliance is no longer just about adherence, it’s about alignment. The most forward-thinking firms are fusing AI governance and regulatory intelligence into the very architecture of their decision-making. The below matrix visualizes the critical risks introduced by AI adoption and the intelligent countermeasures shaping compliant innovation:

AI Risk Node | Impact on Operations | Finela-Style Intelligent Mitigation |

Data Privacy Breach | Exposure of sensitive LP and portfolio data | Deploy zero-knowledge proofs, end-to-end encryption, and role-based access models. |

Algorithmic Bias | Distorted valuations, unfair outcomes | Embed fairness-aware ML models and bias auditing protocols using diverse datasets. |

Operational Disruption | Erroneous predictions or outages during transactions | Implement redundant AI systems and automated failover protocols for resilience. |

Transparency Gap | Regulatory scrutiny of “black box” AI | Adopt explainable AI frameworks (e.g., SHAP values) and maintain clear model logs. |

Regulatory Misalignment | Non-compliance with emerging AI governance standards | Build real-time RegTech dashboards to align with jurisdictional policies. |

Finela Insight:

AI compliance is no longer a constraint, it’s a competitive differentiator. The firms that master explainable, ethical, and adaptive AI will define the next era of private capital performance.

Future Operating Models & Technology-Enabled Risk Management.

Fund operations are shifting from static structures to intelligent ecosystems. The next generation of COOs must balance innovation with resilience, using technology to build adaptable, transparent, and data-driven operating frameworks.

The New Operating Model Landscape: Shift from operator → ecosystem architect.

Model | Defining Feature | COO Imperative |

Collaborative Funds | GP-LP alignment through joint value creation. | Redesign governance for shared control and real-time transparency. |

Evergreen Funds | Continuous capital cycles without drawdowns. | Strengthen liquidity management and long-term cashflow modeling. |

Stakeholder Governance | ESG, compliance, and transparency integration. | Centralize reporting and oversight across investors and regulators. |

Technology as the Risk Intelligence Core: Risk becomes data, not disruption.

Tech Layer | Operational Role | Strategic Advantage |

AI & ML | Predictive risk detection, liquidity stress testing. | Enables foresight-driven decision-making. |

RPA | Automates compliance and regulatory reporting. | Reduces friction and human error. |

Blockchain | Counterparty transparency and secure settlement. | Builds immutable trust layers. |

Cloud & Cybersecurity | Scalable, compliant infrastructure. | Enhances resilience and audit readiness. |

Actionable Next Steps for Fund COOs:

Integrate AI portfolio intelligence across the investment lifecycle.

Deploy RPA for compliance and reporting automation.

Embed ESG and regulatory metrics into unified dashboards.

Adopt continuous cyber and data resilience frameworks.

Conclusion & Strategic Imperative: Operational Intelligence as Competitive Advantage.

Private capital operations are no longer isolated functions, they are the defining differentiator in a market where technology, investor expectations, and regulatory complexity converge. The firms that succeed tomorrow will be those that transform operational pressure into operational intelligence today.

Across the investment lifecycle:

Technology Adoption: Fragmented data and manual workflows can no longer constrain performance. AI-driven portfolio intelligence, predictive analytics, and RPA must be deployed to automate diligence, monitoring, and reporting, enabling faster, more accurate decision-making.

Investor Demands: Transparency, ESG integration, and collaborative value creation are now table stakes. Embedding ESG scoring into deal evaluation and governance frameworks aligns capital with impact, building trust and long-term relationships.

Regulatory Complexity: Real-time oversight and cross-border compliance require proactive stewardship. RegTech, automated reporting, and structured governance frameworks transform compliance from a reactive obligation into a source of credibility and strategic advantage.

The C-Suite Imperative: Leadership is no longer about oversight, it is about orchestration. Modern executives must:

Champion technology literacy and enterprise-wide AI adoption.

Translate ESG purpose into measurable performance.

Embed predictive compliance into every operational layer.

Actionable Takeaways for Next-Generation Fund Operations:

Audit workflows and identify high-impact automation opportunities across pre-investment, execution, and post-investment stages.

Integrate ESG, AI, and regulatory metrics into unified dashboards to drive transparency, accountability, and foresight.

Establish resilient, adaptive governance frameworks that evolve with regulatory standards and market expectations.

Finela Insight:

Firms that embed intelligence at the heart of their operations, turning data into insight, compliance into confidence, and ESG into measurable value, will define the private capital landscape of tomorrow. Operational excellence is not a destination; it is the ongoing capability to sense, act, and adapt faster than the competition. The time to act is now.

“Tomorrow’s fund won’t just be managed it will be intelligently orchestrated.”

Finela empowers fund leaders with an AI operating layer that unites data, governance, and foresight into a single intelligent infrastructure.