Over the past decade, private markets have undergone one of the most rapid periods of institutionalisation in their history. According to Preqin, global private capital assets under management grew from approximately $4 trillion in 2010 to over $13 trillion by 2023, driven by larger fund sizes, longer fund durations, and the rise of multi-strategy platforms spanning private equity, private credit, secondaries, real assets, and hybrid strategies.

To support this growth, firms invested heavily in infrastructure. Fund administrators such as SS&C, State Street, Apex, and Gen II became deeply embedded in operating models. Portfolio and valuation platforms including eFront, Allvue, iLEVEL, and Burgiss professionalised reporting and analytics. Business intelligence tools like Power BI and Tableau proliferated across finance and investment teams. On paper, private markets have never been better equipped.

Yet across CFOs, COOs, and investment professionals, a persistent theme has emerged:

“We have the data, but it still takes too long to understand what’s actually going on.”

This observation is not anecdotal. Deloitte, Bain, and McKinsey have all noted that as private markets firms scale, institutional friction increasingly shifts from transaction processing to interpretation, explanation, and coordination. The constraint is no longer access to information, but the ability to reason across fragmented information at speed and with confidence.

This gap between having information and being able to understand it, is what this report refers to as the intelligence gap. It is subtle, cumulative, and largely invisible until it becomes a binding constraint on decision-making.

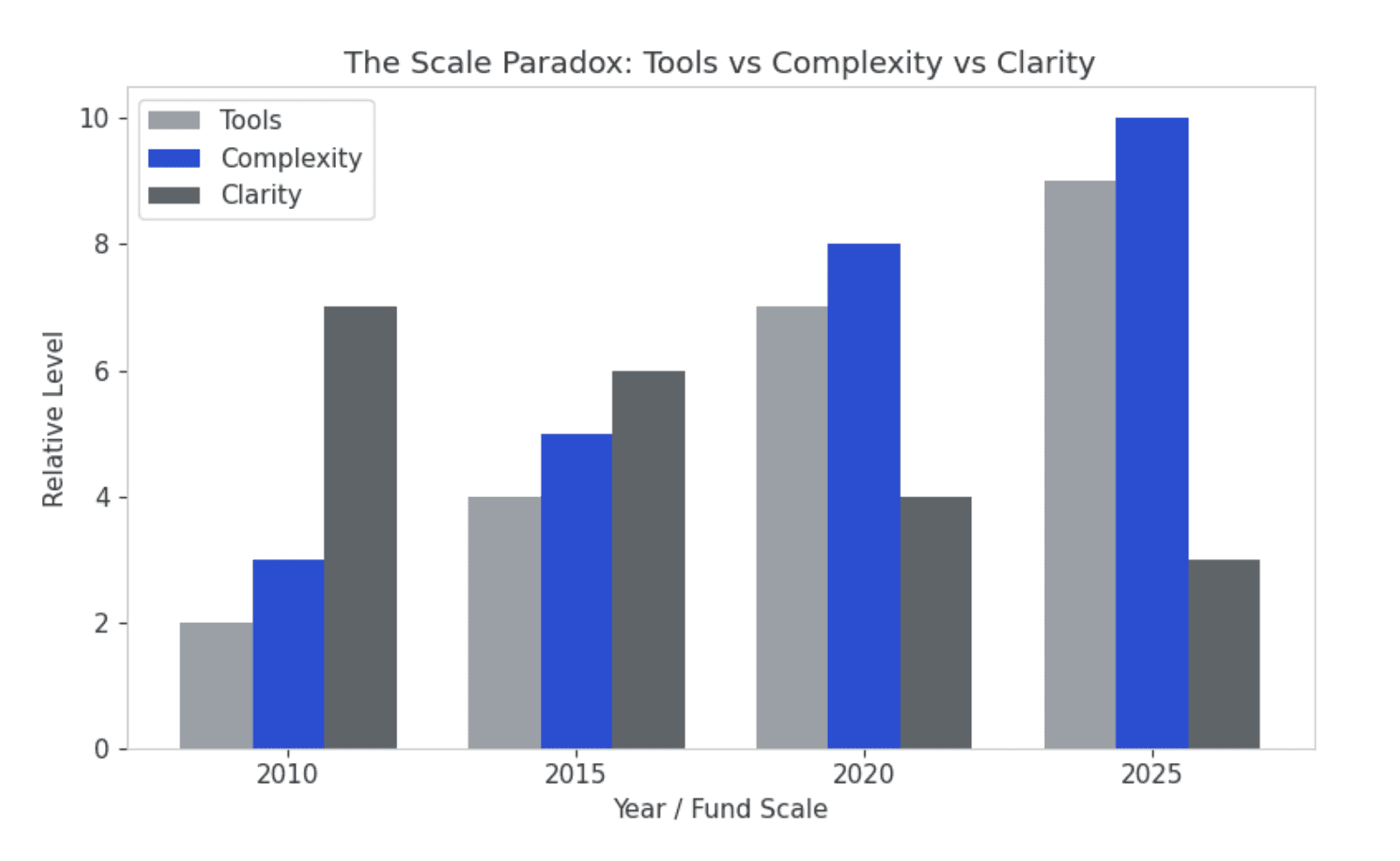

THE SCALE PARADOX.

Capital up. Tools up. Clarity down.

Private markets firms have scaled along three axes simultaneously.

First, capital. Flagship funds have grown significantly larger, often running in parallel with multiple vintages, co-investment vehicles, and continuation funds. Second, strategy. Many firms now operate across buyout, growth, private credit, secondaries, and opportunistic strategies within a single platform. Third, infrastructure. Firms have layered administrators, accounting platforms, portfolio systems, and reporting tools to manage this complexity.

In theory, these developments should have improved clarity and control. In practice, many firms experience the opposite:

Reporting cycles feel longer, not shorter

Variance explanations consume disproportionate senior time

Confidence in outputs depends on who prepared them

Leadership discussions increasingly focus on reconciling numbers rather than acting on them

This is the scale paradox:

as capital, complexity, and tooling increase, institutional understanding becomes harder to maintain.

The paradox exists because systems were designed to scale volume and precision, not context and reasoning. They excel at producing outputs, but they do not explain relationships, assumptions, or drivers of change. As a result, the cognitive burden shifts to people quietly and cumulatively.

SYSTEMS SOLVED TRANSACTIONS, NOT REASONING.

Modern private markets infrastructure is highly effective at well-defined tasks. Accounting systems process capital calls, distributions, fees, and expenses with increasing automation. Portfolio management platforms calculate IRRs, MOICs, valuations, and exposure metrics. BI tools aggregate and visualise outputs across funds and portfolios.

However, these systems consistently fall short when teams ask higher-order questions:

Why did NAV move this quarter?

Which assumptions diverged from underwriting?

Why do internal views differ from administrator reports?

What changed materially since the last IC or LP update?

Answering these questions requires interpretation, not calculation.

As a result, firms rely on humans to:

Reconcile timing and classification differences

Interpret valuation movements and performance drivers

Translate outputs into narratives suitable for ICs, LPs, and auditors

This creates a structural distinction:

Accuracy is delivered by systems

Understanding is manufactured manually

The intelligence gap exists precisely where systems stop and human reasoning begins. This is not a failure of technology, but a mismatch between what systems were designed to do and what scaled organisations now require.

THE FRAGMENTATION REALITY.

Too many representations of the same truth.

In most private markets firms, the same economic reality exists across multiple artefacts:

Administrator capital statements and NAV reports (official, delayed)

Excel trackers and internal models (flexible, fragile)

Valuation memos and PDFs (static, non-queryable)

Email threads containing critical context and explanations

Each artefact is valid within its own domain. None reconcile or explain themselves.

As a result, firms experience recurring operational patterns:

Manual variance analysis between internal and external views

“Version of truth” discussions late in reporting cycles

Escalation of basic questions to senior staff who hold context

According to KPMG, reconciliation and explanation work consumes a disproportionate share of senior finance and operations time, particularly during quarter-end closes and LP reporting cycles.

Fragmentation, therefore, is not about poor tooling.

It is the absence of a shared reasoning layer that connects outputs into understanding.

THE INVISIBLE OPERATING LAYER.

Between formal systems sits an informal but critical operating layer composed almost entirely of human effort:

Reconciliation logic

Interpretation of timing and classification

Explanation of assumptions and judgement calls

Coordination between finance, operations, and investment teams

This layer is rarely documented and almost never visible to leadership until it fails. Yet it underpins:

Audit readiness

LP confidence

Investment committee decisions

As firms scale, this invisible layer becomes the true bottleneck. Not because teams lack competence, but because manual reasoning does not scale reliably with complexity.

The risk manifests as:

Key-person dependency

Institutional knowledge loss

Operational fragility during turnover or growth

Traditional system upgrades do not address this layer, because it was never explicitly designed.

Task Type | % of Time | Critical? | Automatable? |

Reconciling data | 40% | Yes | Partial |

Interpreting variance | 30% | Yes | No |

Generating reports | 20% | Yes | Partial |

Admin / copying | 10% | Low | Yes |

WHY THIS WORKED BEFORE, AND WHY IT’S BREAKING NOW.

Historically, this operating model was viable. Funds were smaller. Strategies were simpler. Teams were stable and founder-led. LP expectations focused primarily on outcomes, not granular explanations.

Institutional memory filled the gaps.

Today, several forces have fundamentally altered this balance:

Multi-vehicle, multi-strategy complexity

Leaner teams managing significantly larger AUM

Higher staff turnover and distributed knowledge

LPs demanding faster, more transparent reporting

Regulatory scrutiny, including the SEC Private Fund Adviser Rules

The result is a structural mismatch between operating complexity and cognitive capacity.

The failure mode is not system failure.

It is slower decisions, higher operational risk, and increased burnout among high-leverage staff.

Complexity vs Operational Strain

Factor | Description | Current Impact |

Multi-strategy funds | More reporting lines | High |

LP transparency | Faster, customized reporting | High |

Lean teams | Fewer hands to do manual reasoning | High |

Regulatory pressure | Traceability & audit | Medium |

A NEW LAYER IS EMERGING.

From systems of record to systems of understanding.

As private markets firms have scaled, a quiet shift has begun to take place in how leading platforms think about infrastructure. Rather than replacing administrators, accounting systems, or portfolio management tools, firms are increasingly recognising that the true bottleneck lies above these systems, in the layer where information must be reconciled, interpreted, and explained.

This has given rise to a new category of capability: an intelligence and operating layer that sits on top of the existing stack.

Unlike traditional systems, this layer is not transactional. It does not calculate NAVs, post journal entries, or price assets. Instead, it is designed to aggregate outputs from multiple systems and artefacts, preserve reasoning, and support human decision-making at scale.

Crucially, this layer is read-only by design. Best-in-class firms are highly sensitive to operational and regulatory risk, and have no appetite to introduce additional sources of record. The emerging layer instead consumes data and documents, Excel models, administrator reports, PDFs, emails, and focuses on what existing systems do not: explainability, traceability, and context.

This reflects a broader trend observed by McKinsey and others across financial services: as organisations scale, value increasingly shifts from processing efficiency to cognitive efficiency, reducing the time and effort required to understand, validate, and act on information.

In private markets, where judgement, narrative, and defensibility matter as much as precision, this shift is particularly pronounced.

WHAT BEST-IN-CLASS FIRMS DO DIFFERENTLY.

Across large, complex private markets platforms, best-in-class firms share one consistent advantage:

They minimise the cost of understanding.

They do not rely on expanding spreadsheet ecosystems, heroics during reporting cycles, or institutional memory locked in individuals.

Instead, they prioritise:

Centralised context

Persistent explanations

Reduced reasoning friction across teams

Their operating question shifts from: “Do we have the data?” to: “Can someone else understand this without a meeting?”

This shift, while subtle, has profound implications for scale, resilience, and decision quality.

“Old vs New Approach”

Dimension | Typical Firm | Best-in-Class |

Tooling | Add dashboards | Add intelligence layer |

Process | Manual recon | Explainable outputs |

Knowledge | Fragmented | Centralized, shareable |

Decisions | Reactive | Insight-driven |

WHAT THIS MEANS FOR LEADERSHIP.

CFOs, COOs, and Investment Teams

For CFOs, the intelligence gap manifests as reconciliation drag, reporting risk, and dependence on key individuals. Closing the gap enables faster closes with defensible narratives and greater confidence under audit and LP scrutiny.

For COOs, fragmentation creates hidden fragility. Closing the gap reduces invisible workflows, lowers key-person risk, and enables operations to scale without brittleness.

For Investment teams, the gap slows insight and obscures drivers of performance. Closing it enables faster understanding post-close and clearer linkage between underwriting and reality.

Bottom line:

Superior outcomes in private markets increasingly depend not on having more data, but on understanding existing data better.

Pain points vs actionable benefit

Pain Point | Actionable Benefit of Closing Gap |

Endless reconciliation | Reduced cycle time, faster month-end |

Audit friction | Traceable, explainable numbers |

Dependence on individuals | Knowledge retained in systems |

CONCLUSION.

Private markets have reached a new phase of institutional maturity. Capital has scaled. Strategies have diversified. Infrastructure has professionalised. Yet the ability to understand what is happening across funds, portfolios, and stakeholders has not kept pace.

This report has argued that the resulting intelligence gap is not a failure of systems or talent. It is the natural outcome of operating models built to process transactions, now being asked to support reasoning, explanation, and defensibility at scale. Across CFOs, COOs, and investment teams, the same pressures are evident:

Increasing fragmentation across systems and artefacts

Growing reliance on manual reconciliation and institutional memory

Rising expectations from LPs, auditors, and regulators

Decision latency driven by the cost of understanding, not the lack of data

Left unaddressed, this gap manifests as operational drag, key-person risk, slower decisions, and avoidable strain on high-leverage teams.

Leading firms are responding differently. Rather than adding more systems or rebuilding core infrastructure, they are focusing on reducing the cost of understanding, introducing intelligence layers that preserve context, explain change, and support human judgement without introducing new sources of record.

The shift underway is subtle but structural: from managing complexity to orchestrating clarity.

CORE TAKEAWAYS.

The primary bottleneck in private markets is no longer data or tooling, it is understanding.

Firms have modern systems, but pre-institutional intelligence models.

Fragmentation is structural, not accidental.

Multiple valid representations of the same reality will continue to exist. The question is whether they can be reasoned across efficiently.

Manual reasoning does not scale.

As portfolios, vehicles, and stakeholders multiply, reliance on human reconciliation becomes a source of risk, not resilience.

Best-in-class firms reduce reasoning friction.

They invest in explainability, context, and shared understanding, not just faster reporting.

A new intelligence layer is emerging.

Read-only, explainable, and human-centric, designed to sit above existing systems, not replace them.

CORE TAKEAWAYS & NEXT STEPS.

ACTIONABLE NEXT STEPS FOR READERS

1. Diagnose your intelligence gap.

Ask whether your firm can reliably answer:

What changed?

Why did it change?

Who can explain it, and would they still be here in 12 months?

If the answer depends on specific individuals or offline reconciliation, the gap is already present.

2. Map your invisible operating layer.

Identify where reconciliation, interpretation, and explanation occur today.

If this work lives in spreadsheets, inboxes, or people’s heads, it represents institutional risk.

3. Reframe technology decisions

Before adding new systems, ask:

Does this reduce the cost of understanding?

Does it preserve reasoning over time?

Does it make explanations easier, not just outputs faster?

4. Align leadership on clarity as a scaling objective.

Treat understanding as a first-class operating metric, alongside speed, accuracy, and control.

5. Prepare for the next phase of institutional scrutiny.

LPs, regulators, and boards increasingly expect not just numbers, but defensible narratives. Firms that can explain change confidently will move faster and earn trust more easily.

REFERENCES APPENDIX.

Preqin Global Private Capital Report 2023

Preqin Ltd. (2023). Global Private Capital Assets Under Management & Market Trends 2010–2023. London: Preqin.

Available at: https://www.preqin.com/insights/research

Deloitte: Private Equity Operations: The New Agenda

Deloitte LLP. (2022). Private Equity Operations: Optimizing Infrastructure and People for Scale.

Available at: https://www2.deloitte.com

McKinsey & Company: Global Private Markets Review 2024

McKinsey & Company. (2024). Private Markets: Scaling Operations in a Complex Landscape.

Available at: https://www.mckinsey.com/industries/private-equity

Bain & Company: Scaling PE Platforms

Bain & Company. (2022). Private Equity Operational Benchmarks and Best Practices.

Available at: https://www.bain.com/insights/private-equity

EY: Transforming Fund Reporting and Analytics

Ernst & Young LLP. (2021). Private Fund Reporting Transformation: Leveraging Technology for Insight.

Available at: https://www.ey.com/en_gl/private-equity

CFA Institute: Investment Decision-Making in Alternative Assets

CFA Institute. (2020). Decision-Making and Risk Management in Private Equity and Hedge Funds.

Available at: https://www.cfainstitute.org/en/research

KPMG: Private Equity – A Pragmatic View of Operations

KPMG LLP. (2021). Private Equity Operations: Addressing Complexity and Fragmentation.

Available at: https://home.kpmg/xx/en/home/industries/private-equity.html

ILPA Reporting Best Practices

Institutional Limited Partners Association (ILPA). (2021). ILPA Reporting and Transparency Guidelines, 3rd Edition.

Available at: https://ilpa.org

PwC: Asset & Wealth Management Operational Risk Insights

PwC. (2022). Operational Risk Management in Private Markets.

Available at: https://www.pwc.com/assetmanagement

COSO: Internal Control – Integrated Framework

Committee of Sponsoring Organizations of the Treadway Commission (COSO). (2013). Internal Control – Integrated Framework.

Available at: https://www.coso.org

SEC Private Fund Adviser Rules (2023)

U.S. Securities and Exchange Commission. (2023). Amendments to Rules Governing Private Fund Advisers.

Available at: https://www.sec.gov/rules/final

McKinsey Digital: Knowledge & Decision Platforms

McKinsey & Company. (2021). Digital Knowledge Management and Decision Support in Asset Management.

Available at: https://www.mckinsey.com/digital

Bain & Company: PE Operating Partner Playbooks

Bain & Company. (2020). Scaling Operations Across Complex Private Equity Portfolios.

Available at: https://www.bain.com/insights/private-equity

McKinsey: Organising for Scale in Alternatives

McKinsey & Company. (2022). Operating Models for Large Private Markets Platforms.

Available at: This report introduces the intelligence gap.

The next reports in this series will explore how it manifests across:

Each will focus on one role, one problem, and one operational truth.

“Tomorrow’s funds won’t just be managed, they will be intelligently orchestrated.”

Finela provides a secure intelligence and operating layer that sits above existing fund systems, enabling leaders to reason across data, governance, and context in a single, explainable workspace.